UNDERSTANDING RETURNS FROM MUTUAL FUNDS

MEASURING PERFORMANCE

While looking at a mutual fund scheme’s performance, one must not be led by the scheme’s return in isolation. A scheme may have generated 10% annualised return in the last couple of years. But then, even the market indices would have gone up in similar way during the same period. Under-performance in a falling market, i.e. when the NAV of the scheme falls more than its benchmark (or the market), is the time when you must review your investment.

One must compare the scheme’s return as against its benchmark return.

In addition, one may also consider evaluating the ‘category average returns’ as well. Even if a scheme has outperformed its benchmark by a decent margin, there could be better performers in the peer group. The category average returns will reveal how good (or bad) is one’s investment is against its peers which help in deciding whether it is time shift the investment to better performers.

One may be holding a too little or too much-diversified portfolio. Even the expense ratio of some of the schemes that one could be holding may be high compared to others within the same category.

Most importantly, the review helps an investor validate if the investments are aligned to his/her goals.

HOW OFTEN SHOULD ONE REVIEW

One should avoid the temptation to review the fund’s performance each time the market falls or jumps up significantly. For an actively-managed equity scheme, one must have patience and allow reasonable time – between 18 and 24 months – for the fund to generate returns in the portfolio.

The review may become more pronounced in case of thematic or sectoral schemes as they are more prone to the changing economic environment.

It is advisable for common investors to make a separate watch list of funds that are found to be underperforming their benchmark or their comparable peers. From this list, one should look for improvement in performance over the subsequent 2-3 quarters. A consistent under-performance over 3-4 quarters may warrant shifting the investment to other better options. One needs to even check the reason for the under-performance, which may be expressed in the fund manager’s commentary. The underlying stocks in the portfolio of an MF scheme keep changing and along with it change the associated risks. An important factor is the risk metrics. If the risk profile of the fund has skewed further towards “High” risk while the returns remain the same or do down, it may be advisable to exit the fund.

Therefore, a review of the fund’s risk-adjusted return, i.e., a measure to find how much return an investment will generate given the level of risk associated with it, could be more helpful.

As an investor, high return at low risk is always preferable. Hence, MF schemes with high risk-adjusted returns are most sought-after. Risk-adjusted returns are well captured by several rating agencies.

The winners of today may not continue with the winning streak year after year. In other words, reviewing the performance as mentioned above may not always be fruitful. Moreover, tracking and reviewing of a scheme’s portfolio is quite different from reviewing one’s own portfolio. A mutual fund investor should not worry themselves about the portfolio of a fund. That’s the fund manager’s job.

WATCH OUT

Be mindful not to disrupt your overall portfolio allocation, while redeeming units from equity mutual fund schemes, as the redemption proceeds would have to be re-deployed in another equity scheme which will require undergoing the entire process of choosing the right scheme to invest in. Try to maintain the original levels of exposure to equities, unless your allocation needs a change.

Frequent review and tracking of mutual fund returns may tempt you into taking unwarranted impulsive decisions. Do not let an fall in NAVs tempt you to discontinue SIPs or redeeming units from a fund. When there are market falls steeply, try to invest lump-sum amount. An annual review comparing the fund with the benchmark as well as with the category peers will certainly help and advisable.

CALCULATING RETURNS ON MUTUAL FUND UNITS

There are many ways to calculate returns from mutual fund investments. Two of the most popular methods are Absolute returns and Annualised returns.

Absolute returns

Absolute return is the simple increase (or decrease) in your investment in terms of percentage. It does not take into account the time taken for this change.

So if an investment’s current market value is Rs. 5,25,000 and your invested amount was Rs. 2,75,000 then your absolute return will be: [(5,25,000-2,75,000)/2,75,000] = 90.9%

Notice how irrelevant the date of investment or date of redemption is. Ideally, you should use the absolute returns method if the tenure of your investment is less than 1 year.

For periods of more than 1 year, you need to annualise returns; which means you need to find out what the rate of return is per annum.

Annualised returns

A Compound Annual Growth Rate (CAGR) measures the rate of return over an investment period. It is a smoothened rate because it measures the growth of an investment as if it had grown at a steady rate, on an annually compounded basis.

CAGR = [(Current Value / Beginning Value) ^ (1/# of Years)]-1

How can I find the CAGR using the computer?

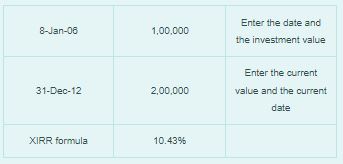

To calculate a CAGR, use the XIRR function in MS Excel.

Please remember to put a negative sign as the XIRR formula calculates the return on cash flows. Thus to find returns there has to be a cash inflow and cash outflow, which should be indicated with the use of positive and negative signs.

ACTIVELY MANAGED FUNDS AND PASSIVELY MANAGED FUNDS

Actively managed funds are those where the fund manager actively manages these funds and buys or sells stocks of companies as per the broad guidelines that have been enumerated in the scheme information document sells stocks. These funds don’t mimic the index but buy and sell on basis of the research of the fund manager.

Passive funds on the other hand look at offering returns by mimicking an index like a BSE or Nifty. The whole point of Index fund is to follow a certain benchmark, and therefore they are called passively managed funds.

UNDERSTANDING ALPHA. HOW DOES IT MEASURE THE FUND MANAGER’S CONTRIBUTION?

But how can I measure the fund manager’s contribution to performance?

This brings us to the question, how exactly can you measure a fund manager’s contribution to performance? Alpha measures the performance due to stock selection. It is the difference between the return you would expect from a fund, given its beta and the return it actually produced. If the fund returns more than its beta would predict, it has a positive alpha and if it returns less than the amount predicted by the beta, that would mean that the fund has a negative alpha.

A positive alpha is the extra return would be awarded to you for taking a risk, instead of accepting the market return.

UNDERSTANDING BETA

Beta measures the volatility of a security relative to something, usually a benchmark index. A beta greater than one means the fund or stock is more volatile than the benchmark index, while a beta of less than one means the security is less volatile than the index.

If the market goes up by 10%, a fund with a beta of 1.0 should go up 10% and vice versa. While standard deviation determines the volatility of a fund according to the disparity of its returns over a period of time, beta, determines the volatility, or risk, of a fund in comparison to that of its index or benchmark.

Beta is based on the capital assets pricing model which states that there are two kinds of risk in investing in equities- systematic risk and non-systematic risk. Systematic risk is integral to investing in the market and cannot be avoided. Eg. risk arising out of inflation and interest rates. Non-systematic risk is unique to a company – can be mimimised by diversification across companies. Since non-systematic risk can be diversified, investors need to be compensated for systematic risk which is measured by Beta.

UNDERSTANDING STANDARD DEVIATION

Usually denoted with the letter σ, Standard Deviation is defined as the square root of the variance.

It basically serves as a measure of uncertainty. Volatile securities that have a higher standard deviation are also considered a higher risk because their performance may change quickly, in either direction and at any moment.

So the standard deviation of a fund measures this risk by measuring the degree to which the fund fluctuates in relation to its mean return i.e. the average return of a fund over a period.

For example, a fund that has a consistent four year return of 3%, would have a mean, or average of 3%. The standard deviation for this fund would then be zero because the fund’s return in any given year does not differ from its four year mean of 3%.

The standard deviation of a set of data measures how “spread out” the data set is. In other words, it tells you whether all the data items bunch around close to the mean or if they are “all over the place.”

What you need to take out of this is that the fund with the lower standard deviation would be more optimal because it is maximizing the return received, for risk acquired.

Imagine you have a choice between two stocks: Stock A historically returns 5% with a standard deviation of 10%, while Stock B returns 6% and carries a standard deviation of 20%, which one do you think is more risky?

Stock A has the potential to earn 10% more than the expected return, but is equally likely to earn 10% less than the expected return. Likewise Stock B can vary by up to 20%.

So on a risk and return perspective, Stock A is less risky than Stock B.