NEW RULE ON APPLICABLE NAV EFFECTIVE FROM 1ST FEB. 2021

CUT-OFF TIMINGS FOR MUTUAL FUND TRANSACTIONS

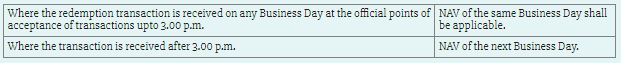

For determining applicable Net Asset Value (NAV) for subscription and redemption transactions

WHAT IS THE NEW RULE ON APPLICABLE NAV?

As per SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings for purchase transactions, irrespective of the amount of investment, under ALL mutual fund schemes. (The above rule is already applicable for purchase transactions under Liquid funds and Overnight Funds).

WHEN WILL THE NEW RULE COME INTO EFFECT?

The revised rule is applicable for all purchase transactions received from 1st Feb. 2021.

TO WHICH TRANSACTIONS IS THE NAV BASED ON REALIZATION OF FUNDS APPLICABLE ?

All purchase transactions – whether Initial purchase or additional purchase of units; whether lump-sum investment or under Systematic Investment Plan (SIP); irrespective of the amount of investment.

Purchase of units through Inter-scheme switching of investments, including switch transactions under Systematic Transfer Plan (STP) or trigger events irrespective of the amount of investment.

HOW IS THE APPLICABLE NAV DETERMINED?

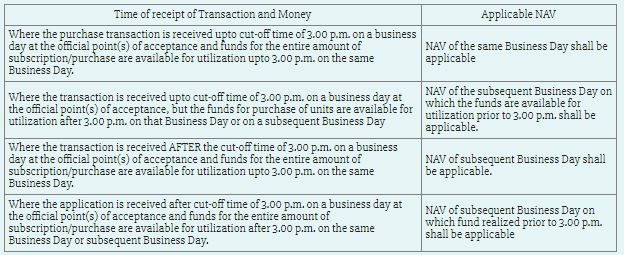

The Applicable NAV for purchase transactions (including Switch-In transactions) under all mutual fund schemes (other than Liquid funds and Overnight Funds) irrespective of the amount of investment, shall be determined as follows:

ILLUSTRATIONS TO EXPLAIN THE NEW APPLICABLE NAV RULE (EFFECTIVE FROM 01-FEB-2021)

a) Lump Sum purchase transaction for say, ₹50,000 received (time stamped) before cut-off time of 3.00 p.m. on Thursday 11-Feb-2021

If the funds are received in the mutual fund’s account before cut-off time of 3.00 p.m. on 11th February 2021, the investor will be allotted closing NAV of 11-Feb-2021. However, if the funds are received in the mutual fund’s bank account at say 5.00 p.m. on 11th February 2021, i.e., after the cut-off time of 3.00 p.m., the allotment of units will be done at the NAV of Friday 12-Feb-2021. However, if the funds are received in the mutual fund’s bank account at say 4.00 p.m. on Friday 12-Feb-2021, the units will be allotted at the closing NAV of Monday 15-Feb-2021 (Feb. 13 & 14 being Saturday & Sunday i.e., non-business days).

In short, the units are allotted at the NAV of the business day on which the funds are received into the mutual fund account before applicable cut-off time.

b) SIP Transaction

Assuming an investor has signed up for SIP transaction of say, ₹5,000 to be debited on 10th of every month. Hitherto, the investor would have been allotted SIP units at the NAV for 10th the month (assuming the same is a Business day) irrespective of the date on which the money was received / credited to the Mutual Fund’s bank account. As per the new Rule, the investor would be allotted the SIP units at the NAV for 10th only if the money is received/credited to the Mutual Fund’s bank account before 3.00 p.m. on 10th. Else, the SIP units will be allotted units at the NAV of the next business day on which funds are received before the cut-off time.

In view of the above, investors are encouraged to avail electronic payment modes for remittance of funds to the mutual fund bank account to facilitate speedy fund transfers.

WHAT IS THE APPLICABLE NAV FOR SWITCHING OF UNITS?

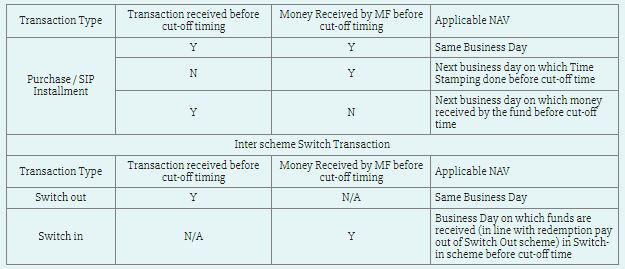

Valid applications for Inter-scheme switching of investments will be considered for processing on the earliest day which is a Business Day for both the ‘Switch out’ scheme and the ‘Switch in’ scheme. Applications for ‘Switch In’ shall be treated as purchase applications and the Applicable NAV based on the cut off time for purchase shall be applied. Applications for Switch Out shall be treated as redemption applications and the Applicable NAV based on the cut off time for redemption shall be applied. Please see Table 2 below.

TABLE 2TRANSACTION WISE NAV APPLICABILITY MATRIX (APPLICABLE FROM 01-FEB-2021)

HOW THE NAV WILL BE DETERMINED, IF THE SUBSCRIPTION MONEY IS TRANSFERRED / CREDITED TO MUTUAL FUND ACCOUNT FIRST AND THE APPLICATION / TRANSACTION IS RECEIVED SUBSEQUENTLY?

In such a scenario, the date & time stamped on the application/transaction will be considered for determining Applicable NAV.

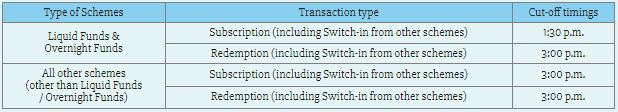

IS THERE ANY CHANGE IN CUT-OFF TIMINGS FOR PURCHASE TRANSACTIONS?

No. There is no change in the existing cut off timings purchase transactions.

DOES THE NEW RULE ON APPLICABLE NAV APPLY TO ALL MODES OF TRANSACTIONS?

Yes. The new NAV Rule is uniformly applicable for all mode of transactions (whether physical or through online platforms such as exchange platforms/online channel partners/MFU etc) In short, the allotment of units will be subject to realization of subscription money irrespective of the mode of transaction.

WHAT WILL THE APPLICABLE NAV ON UNITS ALLOTTED ON REINVESTMENT OF DIVIDEND?

The allotment of units upon reinvestment of dividend will be at ex-dividend NAV.

WHAT ABOUT NFO PURCHASE AND NFO SWITCH-IN TRANSACTIONS?

In case of NFO subscriptions, the Units are allotted in respect all valid applications received till the close of business hours on NFO closure date provided the funds are realised (credited to the mutual fund collection account) prior to allotment of units.

In case of switch transactions from an existing scheme into NFO scheme, the Switch-Out requests received & time stamped before the cut off timing applicable to the source schemes shall be processed, and the units in the NFO scheme will be allotted on Allotment date.

NFO Units are allotted at face value of the Units as specified in the Scheme Information Document.

WHAT IS THE APPLICABLE NAV FOR REDEMPTION OF UNITS (INCLUDING SWITCH-OUTS)?

The Applicable NAV for redemptions continues to be as follows: