Non Convertible Debentures ( NCD ) : Meaning, Features and more

Non-convertible debentures (NCD) are fixed-income instruments, usually issued by high-rated companies in the form of a public issue to accumulate long-term capital appreciation. They offer relatively higher interest rates when compared to convertible debentures.

What are Non Convertible Debentures (NCDs)

Non-convertible debentures fall under the debt category. They cannot be converted into equity or stocks. NCDs have a fixed maturity date and the interest can be paid along with the principal amount either monthly, quarterly, or annually depending on the fixed tenure specified.

Example of NCDs: You can invest when the company announces NCDs or purchase after it trades on the secondary market. You must check the company’s credit rating, issuer credibility and the coupon rate of the NCD. It would help if you purchase NCDs of a higher rating such as AAA+ or AA+.

Features of NCDs

Taxation

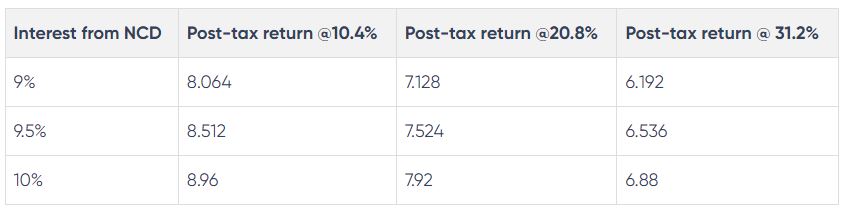

NCDs carry tax implications depending on the tax bracket the investor falls under. If NCDs are sold within a year, STCG will be applicable as per the income tax slab rate. If the NCDs are sold after a year or before the maturity date, LTCG will be applicable at 20% with indexation. The interest income from NCDs is taxed in a similar manner as fixed income securities under ‘income from other sources. Let’s calculate the post-tax return from the NCD:

Credit rating:

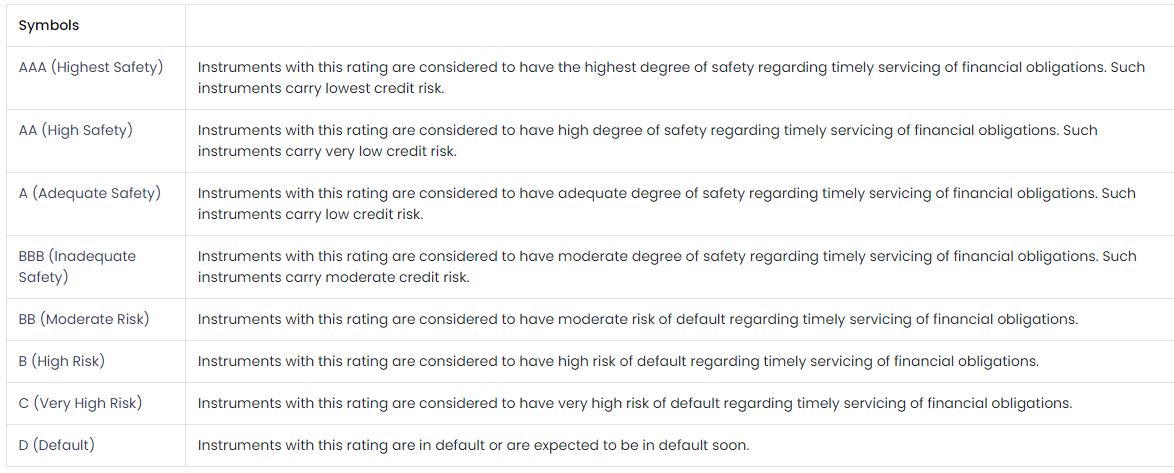

Companies are ranked by credit rating agencies such as CRISIL, CARE etc. To determine the potential of a company, its rating plays a major role. A higher credit rating means that the company has the ability to fulfil credit obligations. However, a low credit rating means that the company has high credit risks involved. If any issuing company fails to make payments then the rating agencies give them a lesser ranking.

Interest:

NCDs may offer a high-interest rate ranging from 7% to 9% if held till maturity. Interest payouts are either monthly, quarterly, half-yearly or annually. NCDs do offer a cumulative payout option, as well. Moreover, unsecured NCDs can offer a higher interest rate.

Things an investor should consider

NCDs are vulnerable to risks related to handling business and funding. Hence, the credit rating can take a hit if the turnover is negatively impacted. The company will have to borrow additional funds from banks or NBFCs to counterbalance the impact. Hence, it is advised to keep a few things in mind before opting for a company NCD.

Credit Rating of the issuer:

Choose a company with an AA rating or above. Credit rating calculates the firm’s potential to raise cash from its internal and external operations and its sustainability. This is the best parameter that can reveal the financial position of the company.

Level of Debt:

Some background check on the asset quality of the company can go a long way for NCD investors. Do not invest if the company allocates more than 50% of its total assets towards unsecured loans.

Capital Adequacy Ratio (CAR):

CAR gauges the company’s capital and sees if the company has sufficient funds to survive potential losses. Ensure that the firm you plan to invest in has at least 15% CAR and have historically maintained the same.

Provisions for Non Performing Assets:

The company must keep aside at least 50% of their assets towards NPAs as this is a positive indicator of their asset quality. If the quality drops due to bad debts, take it as a red flag.

Interest Coverage Ratio

The Interest Coverage Ratio or ICR determines the firm ability to comfortably settle the interest on its loans at any given time. This ensures that the company can handle possible evasions.

Your tax slab

Investors in the 10% and 20% tax slabs find NCDs lucrative. This is because you can earn more if your tax bracket is low.

Types of NCDs

Following are the two kinds of non-convertible debentures:

Secured NCDs:

Secured NCDs are considered safer of the two kinds as their issues are backed by the assets of the company. In the event of the company failing to pay on time, then the investors can recover their dues by liquidating the company’s assets. However, the interest offered on NCDs is low.

Unsecured NCDs:

Unsecured NCDs are much riskier than the secured NCDs as the assets of the company do not back these. Hence, when the company defaults on its payment, the investors have no choice but to wait until they receive payments as there are no assets of the company to recover their dues. However, the interest rate offered on unsecured NCDs is higher than that of secured NCDs.

Tips for investing in NCDs

Organisations resort to raising funds using NCDs only to meet a specific business purpose. Read the terms and conditions – if they do not offer you clarity on how/where your money is going to be used, do not invest.

Diversification, i.e., investing across various firms and periods can reduce the risks considerably.

NCDs from one single sector (NBFCS that focuses on personal loans) are not safe to invest in. This can lead to higher risk exposure.

NCDs from the secondary markets have always delivered higher returns in the past. This is when you buy older NCDs when a firm issues a new one.

Never go by the interest rate alone. It will not matter if the NCD yield (that decides your real returns) remains low.

The perfect time to sell your NCD is when its interest is due. It is the prime trading time for a non-convertible debenture. You can expect to make more money out of it.

FAQs

What are Non- Convertible Debentures?

A Non Convertible debenture is a financial instrument that allows a private or public corporation to borrow money from investors. In other words, when an investor buys a corporate bond, he/she lends money to the company (Issuer). In exchange, the company promises to repay the money (Principal) on a specified date in future (Maturity). Until that date, the company makes regular payment to investors at a specified rate of interest (Coupon). Thus, through a corporate bond, a company gets the money it needs for business operations and investors get a pre-defined interest payment for a specified period in lieu of the money lent to the Issuer.

NCDs are issued by corporates to raise funds from the public and offer a fixed return . This is done through a public issue and subsequently traded either over the counter (OTC) or on exchanges.

Ratings of NCDs issued reflect the position of the issuer in servicing its financial obligations i.e. to pay interest when due and also about the payment of the maturity proceeds on time.

NCDs offer various other benefits to the owner such as high liquidity through stock market listing, tax exemptions at source and safety since they can be issued by companies which have a good credit rating as specified in the norms laid down by RBI for the issue of NCDs.

Which are the major specifics to look at while Buying NCD?

Coupon – Interest paid to the investor periodically. Can range from monthly, quarterly, half-yearly to yearly.

Face Value – Value per bond paid out by Issuer on maturity or on exercise of call option by Issuer

Maturity date – The date on which Issuer repays principal amount.

Credit Rating – Quantified assessment of the creditworthiness of a borrower in general terms or with respect to a particular bond by Credit Rating Agencies

Call option on bonds – Gives issuer of the bond the option to call back the bond before its maturity and repay principal amount. Feature is common in perpetual bonds. The option is exercised by the issuer when interest rates decline and capital requirement can be met at lower cost.

YTM (Yield to Maturity) – Annualized return on the bond realized by an investor if bond is held to maturity.

Accrued Interest – Amount of interest earned on a debt but not yet collected. Interest starts accumulating from the last coupon payment date.

Clean Price – Price of the bond without accrued interest on that bond.

Dirty Price – Clean price of the bond + accrued interest = Dirty Price of the bond. It is the actual consideration paid by buyer of the bond to the seller. Is also known as settlement price of the bond.

What are the risks for investing in NCD?

Credit or Default Risk – Issuers inability to pay interest and/or principal payment due to weakening of creditworthiness. Can be partially mitigated by investing in high rated bonds

Duration Risk – Sensitivity of bond prices to change in interest rates. Higher coupon & higher number of years to maturity results in more price volatility to change in interest rate

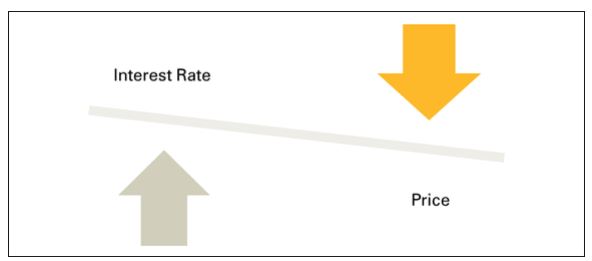

Interest Rate Risk – Change in price of bond to change in interest rates. Bond prices move opposite to the direction of interest rates. When interest rates fall, bond prices go up and vice versa.

Liquidity Risk – Lack of active trading on the bond may result in illiquidity. Bond holders are unable to find buyers for the bond and/or receive sub-optimal price on Sale.

Inflation Risk – Inflation rising above coupon rate resulting in negative real return. For example, if coupon is 6% and inflation rises to 7%, investors fall behind inflation by 1%

Call & Reinvestment Risk – Issuer redeeming principal prior to maturity and inability of buyer to find similar coupon through fresh investment. Witnessed in a falling interest rate scenario.

What is Yield?

1. Bond yield is the return an investor realizes on a bond. It is the anticipated return on an investment, expressed as an annual percentage. For example, a 8% yield means that the investment averages 8% return each year till maturity. Yield is an important concept in bond investing. It is used to measure return of one bond against another and it enables investors to make informed decision while investing in bonds.

2. Yield is commonly measured in two ways, current yield and yield to maturity.

3. A) Current yield

4. The current yield is the annual return on the investment value of bond, regardless of its maturity. If you buy a bond at par, the current yield equals its coupon rate. Thus, the current yield on a par-value bond paying 8% is 8%. However, if the market price of the bond is higher or lower than par, the current yield will be different. For example, if you buy a Rs. 1000 bond with a 8% stated interest rate at Rs. 1100, your current yield would be 7.27% (Rs. 1000 x 0.08/Rs.1100).

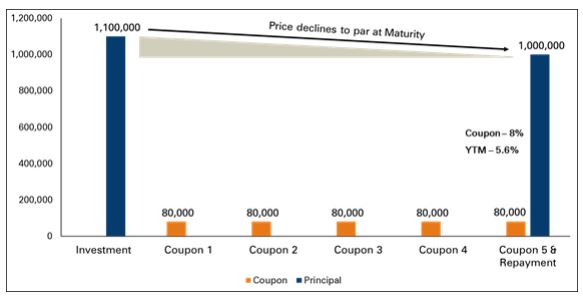

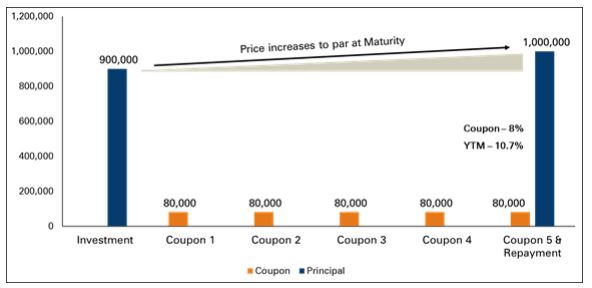

5. B) Yield to maturity

6. It is the total return an investor receives on a bond if held until maturity. It enables one to compare bonds with different maturities and coupon rates. Yield to maturity includes the current yield and the capital gain or loss you can expect if you hold the bond to maturity. If you pay Rs. 900 for a 5% coupon bond with a face value of Rs. 1,000 maturing five years from the date of purchase, you will earn not only Rs. 50 a year in interest but also another Rs. 100 when the bond’s issuer pays off the principal. By the same logic, if you buy that bond for Rs. 1,100, representing a Rs.100 premium, you will lose Rs. 100 at maturity

7. Example 1 – YTM illustration of a 5 year bond with 8% annual interest bought at Premium and held till maturity

8. Example 2 – YTM illustration of a 5 year bond with 8% annual interest bought at discount and held till maturity

What happens if the Yield reduces?

Yield and prices are inversely propotional to each other

If the yield increases the prices are reduced and if yields reduces then prices moves up

When interest rates rise, new issues come to market with higher yields than older securities, making those older ones worth less. Hence, their prices go down

When interest rates decline, new bond issues come to market with lower yields than older securities, making those older, higher-yielding ones worth more. Hence, their prices go up.

Thus, if one sells a bond before maturity, it may be worth more or less than it was paid for.

Actual prices are also affected by the length of time left before the bond matures and by the likelihood that the issue will be called. But the underlying principle is the same, and it is the single most important thing to remember about the relationship between the market value of the bonds you hold and changes in current interest rates: As interest rates rise, bond prices fall; as interest rates fall, bond prices rise. The farther away the bond’s maturity or call date, the more volatile its price tends to be. Because of this relationship, the actual yield to an investor depends in large part on where interest rates stand on the day the bond is purchased

What is credit rating of NCD?

A credit rating is an opinion of a particular credit agency regarding the ability and willingness an entity (government, business, or individual) to fulfill its financial obligations in completeness and within the established due dates. A credit rating also signifies the likelihood a debtor will default. It is also representative of the credit risk carried by a bond. A credit rating is, however, not an assurance or guarantee of a kind of financial performance by a certain instrument of debt or a specific debtor.

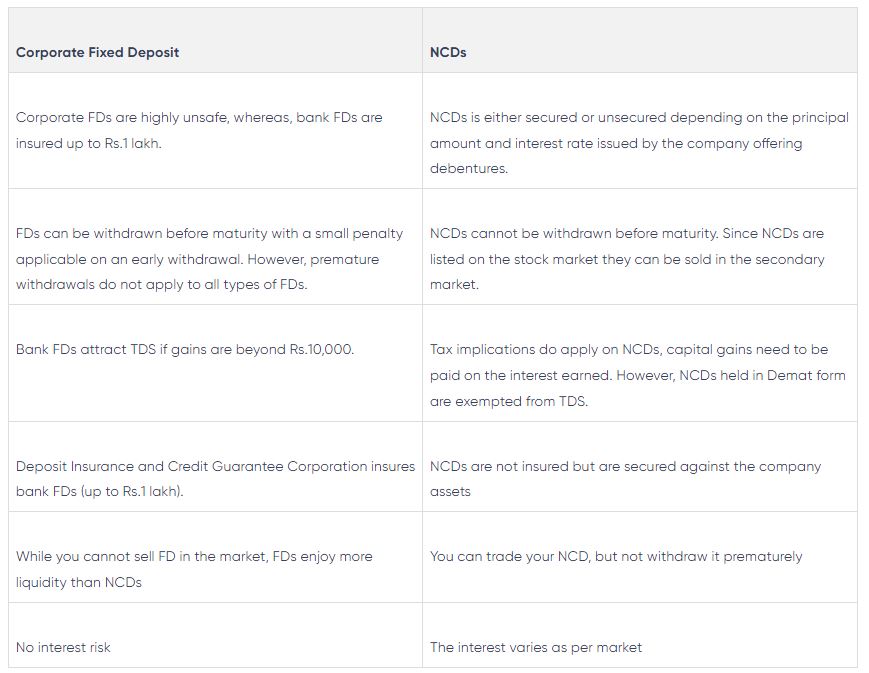

Difference between Corporate FDs and NCDs

Bonds Vs Non-convertible Debentures:- Everything you need to know.

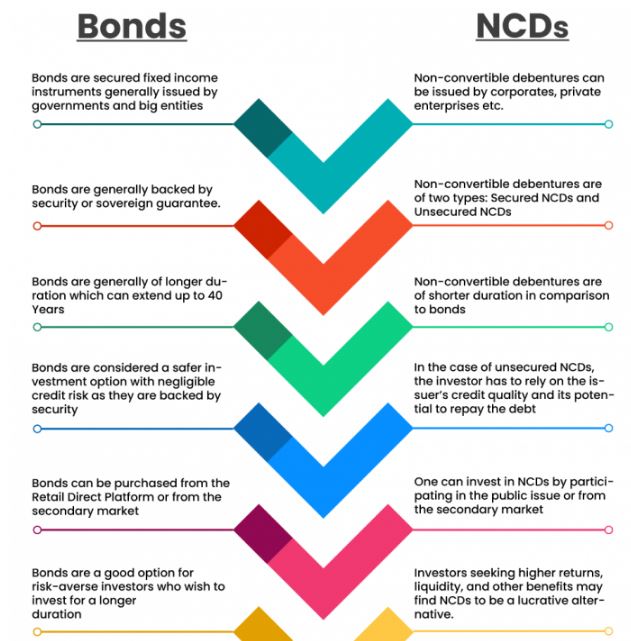

The most typical technique to obtain the needed finances is by borrowing. There are several methods for businesses to borrow money, with bonds and debentures being the most popular options. Non-convertible debentures and bonds are both types of fixed income securities, and many times both words are used interchangeably though they are both distinct Fixed Income Investment Options.

Non-convertible debentures (NCDs) and bonds are fixed-income securities that are issued by companies to raise capital from investors for various requirements, including the expansion or growth of an entity. While both these instruments carry a fixed rate of interest, they differ in terms of the duration of their issue, the issuer’s ability to redeem them, and the risk associated with them. NCDs also tend to be more volatile in nature and involve higher risks as compared to bonds. A bond may be referred to as a non-convertible debenture if it is not secured. In this article, we will be understanding fixed-income instruments like bonds and non-convertible debentures and discussing their advantages and disadvantages.

Bonds:

The most popular type of debt instrument is a bond. They are often issued by private businesses, governments, and other financial entities. They are loans for the issuing entity using pledged assets as security. Bond-issuing organizations take on the role of borrowers by promising to repay the principal and interest at the designated maturity date to the investors or lenders of the funds. Bonds are fixed-income securities wherein the issuer pays a fixed and periodic interest to the investors and on maturity, the principal amount is repaid. At the time of the issue of bonds, the issuer states the terms of the bond. This includes the coupon rate (interest rate on the bond), the face value of the bond, the duration for which the bonds are issued generally known as the maturity date, and various terms and conditions attached to the issue.

Bonds are a type of financial instrument that entities can use to raise more funds from the public for various expansions, working capital requirements, and repayment of existing debts, etc. Private and public enterprises both issue these fixed interest bonds to attract funds from investors. In general, bonds have lower interest rates than debentures as they are backed by the security and timely returns are guaranteed. The lower interest rate represents the reduced credit risk. Bondholders are usually given precedence during the time of liquidation. Bonds are long-term investments in comparison to debentures when it comes to tenure time. However, the issuing business or entity mostly decides the tenure of the issue as per the requirements.

Non-convertible Debentures:

Non-convertible Debentures are a little similar to bonds and can be secured or unsecured debt instruments. Non-convertible debentures means the debentures that cannot be converted into shares of the entity. It is a common method for private enterprises to raise money for a variety of purposes through the issue of Non-convertible debentures. Investors must rely on the issuing company’s credit ratings and financial soundness in case of unsecured non-convertible debentures. Credit rating agencies are regulated by SEBI and they assign ratings based on the health and financial soundness of the entity, debt structure, borrowing and repayment history of the entity, etc. Some widely recognized credit rating agencies in India are CRISIL, CARE Ratings, India Ratings and Research Pvt. Ltd, and ICRA which assign ratings from AAA to D which can help investors in taking an informed decision.

Generally, higher-rated non-convertible debentures also known as investment-grade non-convertible debentures are preferred fixed-income investment options for investors. While the unsecured non-convertible debentures are not secured by any physical assets or security, bonds are backed by the issuer’s assets. Non-convertible debentures have a fixed tenure and interest is paid either quarterly, semi-annually, or annually and the principal is repaid at maturity to the investors. Non-convertible debentures are listed on Stock exchanges which makes them fairly liquid and can be sold in the market. One can invest in Non-convertible debentures through NCD Public Issues or purchase through the secondary market. Thus the high yields, liquidity, and fixed returns make non-convertible debentures a favorable fixed income investment option but it is advisable to invest in NCDs on the basis of one’s risk profile after thoroughly verifying the various parameters of the issuing company.

Unsecured non-convertible Debentures, on the other hand, provide you with a high-interest rate, but because they are unsecured, the level of risk is high. Thus the higher risk level is compensated by more interest rate (coupon rate). Non-convertible secured debentures are considered safer since they are secured by assets, which can be liquidated in the event of default. A rating agency evaluates the creditworthiness of entities, especially their potential to meet principal and interest payments on their debt, and assigns ratings from AAA to D based on the safety and security of instruments. One must check the issuer’s credit rating, its credibility to repay debt, the coupon rate on the Non-convertible debentures, the structure and duration of the issue, etc. before investing in NCD. Find the best NCDs to invest in at TheFixedIncome.com and start investing in fixed income securities.

Non-convertible Debentures vs Bonds

The following table compares bonds and Non-convertible debentures.

Conclusion

Both a bond and a debenture are types of fixed income securities wherein entities borrow money, but they differ in how they are structured. In a way, all bonds are debentures, but not all debentures are bonds. For that reason, many times people use the words Non-convertible debentures and bonds interchangeably. A debenture lacks collateral, but a bond is backed by security. One can invest in NCDs surely for a higher return if one can evaluate the issuer’s creditworthiness and the issuer’s ability to repay the debt. In other words, Bonds are a better option for you if you are new to investing as they are secured and the chances of default are minuscule. Nevertheless, before investing in any fixed income securities like bonds or NCDs, it is advisable to read all the documents relating to the issue and understand all the terms and conditions attached to it.