SYSTEMATIC INVESTMENT PLAN – SIPSebi Complaints Readdress System – Register Complaints Online

Systematic Investment Plan (SIP) is an investment plan (methodology) offered by Mutual Funds wherein one could invest a fixed amount in a mutual fund scheme periodically, at fixed intervals – say once a month, instead of making a lump-sum investment.

The SIP instalment amount could be as little as ₹500 per month. SIP is similar to a recurring deposit where you deposit a small /fixed amount every month.

SIP is a very convenient method of investing in mutual funds through standing instructions to debit your bank account every month, without the hassle of having to write out a cheque each time.

SIP has been gaining popularity among Indian MF investors, as it helps in Rupee Cost Averaging and also in investing in a disciplined manner without worrying about market volatility and timing the market. Systematic Investment Plans offered by mutual funds are easily the best way to enter the world of investments over the long term.

Common sense suggests that “Buying low and selling high” is perhaps the best way to get good returns on your investments. But this is easier said than done, even for the most experienced investors. There are many factors at play when it comes to any market – debt or equity, and all of them are inextricably linked.

SIP is a simpler approach to long term investing is disciplining and committing to a fixed sum for a fixed period and sticking to this schedule regardless of the conditions of the market.

RUPEE COST AVERAGING

Rupee cost averaging, as this practice is called, in a way ensures that you automatically buy more units when the NAV is low and fewer when the NAV is high…e.g., an SIP of ₹1000 gets you 50 units when the NAV is Rs. 20, but gets you 100 units when the NAV is Rs.10. The average cost for buying those 150 units would be Rs. 2000/150 units i.e. ₹ 13.33.

However, please remember that the Rupee cost averaging does not assure profit, nor does it protect one against investment losses in declining markets. It merely ensures disciplined & regular investment in stock markets, which helps overcome the natural impulse to stop investing in a falling or a depressed market or investing a lot, when markets are buoyant and euphoric.

THE POWER OF COMPOUNDING

There is a great advantage with long-term investments, namely, compounding which is considered one of the greatest mathematical discovery.

To put it in simple words, compounding is when the interest (or income) you earn is reinvested in the original corpus and accumulated corpus continues to earn (& grow). Every time this happens, your investment keeps growing, paving the way for a systematic accumulation of money, multiplying over time.

To illustrate, a small amount of ₹1000 invested every month at an interest rate of 8% for 25 years would give you ₹ 9.57 Lakh! That means your investment of just ₹ 3 Lakh would have grown three times over!

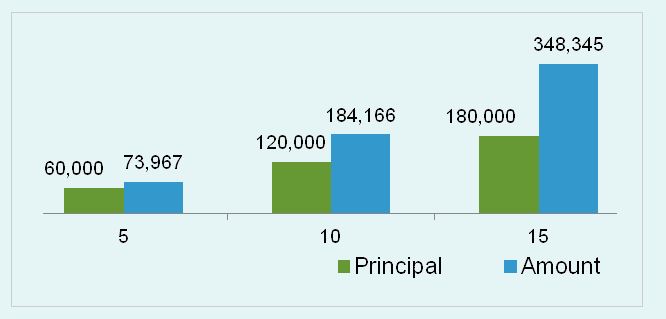

Here is a graph that represents the same for a time period of 15 years.

STARTING EARLY PAYS WELL

To get the best out of your investments, it is very important to invest for the long-term, which means that you should start investing early, in order to maximize the end returns.

Let’s understand this better through an illustration –

Let’s assume that two friends, both aged 25, decide to invest ₹ 2000 every month for a period of 5 years and earn 8% p.a. on a monthly compounding basis. The only difference is that while one starts investing promptly at the age of 25 itself, the other starts investing 10 years later at the age of 35 years. Both decide to hold on to their investments till they turn 60. So while both of them would accumulate principal investment of ₹1.2 Lakh over a period of 5 years, the investment of the person who started early at the age of 25 appreciates to over ₹ 14 Lakh, the investment of the second person who started later grows to only about ₹ 6 Lakh.

Thus, you can clearly see the difference between the two and the clear advantage of investing early. So go ahead. Start investing through SIP today itself.