WHAT IS TOTAL EXPENSE RATIO?

Under SEBI (Mutual Funds) Regulations, 1996, Mutual Funds are permitted to charge certain operating expenses for managing a mutual fund scheme – such as sales & marketing / advertising expenses, administrative expenses, transaction costs, investment management fees, registrar fees, custodian fees, audit fees – as a percentage of the fund’s daily net assets.

All such costs for running and managing a mutual fund scheme are collectively referred to as ‘Total Expense Ratio’ (TER)

Currently, in India, the expense ratio is fungible, i.e., there is no limit on any particular type of allowed expense as long as the total expense ratio is within the prescribed limit. The regulatory limits of TER that can be incurred/charged to the fund by a Mutual Fund AMC have been specified under Regulation 52 of SEBI Mutual Fund Regulations.

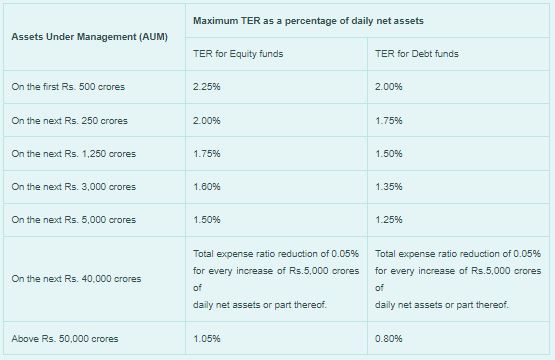

Effective from April 1, 2020 the TER limit has been revised as follows.

In addition, mutual funds have been allowed to charge up to 30 bps more, if the new inflows from retail investors from beyond top 30 cities (B30) cities are at least (a) 30% of gross new inflows in the scheme or (b) 15% of the average assets under management (year to date) of the scheme, whichever is higher. This is essentially to encourage inflows into mutual funds from tier – 2 and tier – 3 cities.

TER has a direct bearing on a scheme’s NAV – the lower the expense ratio of a scheme, the higher the NAV. Thus, TER is an important parameter while selecting a mutual fund scheme.

As per the current SEBI Regulations, mutual funds are required to disclose the TER of all schemes on a daily basis on their websites as well as AMFI’s website.